If you want to use an accountant’s copy as a regular company file to record your transactions without restrictions, then this post for you. You can utilize QuickBooks Desktop Premier Accountant and Enterprise Accountant to change your file. After creating the accountant’s copy, you need to re-enter any changes you made to the original company file once the conversion is done. Read this post until the end to use an accountant’s copy (QBX or .QBA) as a regular company (.QBW) file.

Need to change an accountant’s copy to a regular company file? Give us a call on our helpline number 1.800.579.9430 to get help from qualified experts

Things You Need to Consider before Converting an Accountant’s Copy to a Regular Company File

To use an accountant’s copy as a regular company file (.QBW), you need to convert it to the regular company file in the first place. Before you convert, you need to consider the below-given points:

- Only QB Desktop Premier Accountant and Enterprise Accountant has the feature to convert an accountant’s copy to a regular company file.

- Once you have converted the Accountant’s Copy to a company file, you may not be able to export an Accountant’s Changes (.QBY) file.

How to Change an Accountant’s Copy to a Regular Company File?

To use an accountant’s copy as a regular company file, you need to follow the below-given steps:

QuickBooks Accountant 2015:

If you are using QuickBooks Accountant 2015 and thinking about how to open an accountant’s copy in QuickBooks as a regular company file, then the below-given steps can help.

- Open your accountant’s copy (QBX or .QBA) in the first place and then create a backup of the file to prevent permanent data loss.

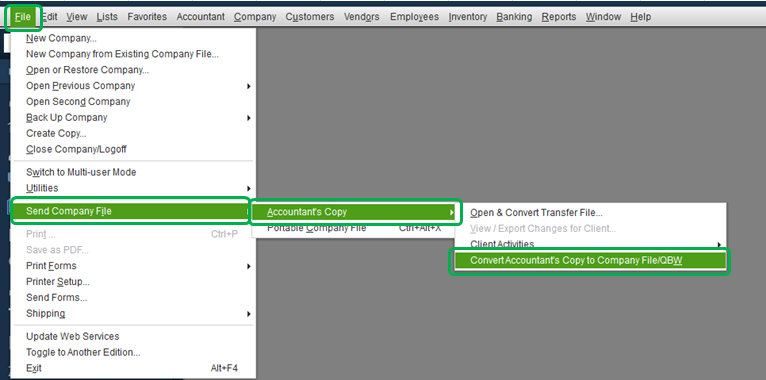

- Next, from within the File menu, select Send Company File, and then further select Accountant’s Copy.

- After that, you need to select Convert Accountant’s Copy to Company File/QBW.

- Select OK to confirm that you want to convert an accountant’s copy to a regular company file.

- Open the folder location where you want to save the .QBW file and then rename the file. Select Save to proceed further.

- Hit OK when you are done.

QuickBooks Accountant 2011 through 2014:

If you are using QuickBooks Account version from 2011 to 2014, then follow the below-given steps:

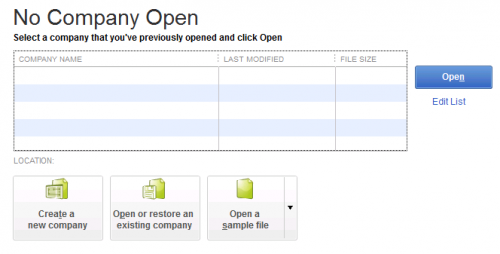

- First of all, open QuickBooks to the No Company Open screen.

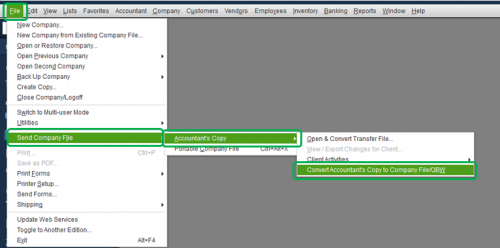

- Next, go to the File menu and choose the Accountant’s Copy then further choose Convert Accountant’s Copy to Company File.

- After that, from Open the Accountant’s Copy to Convert window, you need to find and select the Accountant’s Copy file (.QBX or .QBA extension) that you want to convert.

- Hit Open, and it will open a dialogue box describing the process and limitations that you need to consider before converting an accountant’s copy to a regular company file.

- Click OK.

- Next, from the Name QuickBooks File window, enter the name and location of the file that you are going to create. (Important: make sure that the extension is selected as .QBW for Save as type).

- Hit Save, and it will notify you about the success of the conversion process.

- Hit OK, and you will have a new .QBW file by now.

Read More: What Are The Pros And Cons Of QuickBooks Payroll?

Steps to Convert Accountant’s Copy As a Working file

- Click on the File menu and choose Open and Restore Company.

- After that, click Convert an Accountant’s Copy Transfer File and click Next.

- Go through the Overview and select Next.

- Repeat the same with Can and Can’t Dos and click Next.

- Search and open up the accountant’s copy.

- Affirm that you want to convert the file.

- Change the name of the file and click Save.

Need Further Assistance from QB Experts?

Converting your accountant’s copy working file (.QBA) or transfer file (.QBX) to a regular company file (.QBW) can help you to record transactions without restrictions. If you are getting any technical difficulty in performing the steps, feel easy to dial our helpline number 1.800.579.9430. Once you are connected, get relevant help to use an accountant’s copy as a regular company file.